This week, in its bid to stem the tide of inflation, the US Federal Reserve Bank announced its biggest interest rate hike in 25 years, raising the rate three quarters of a percent. Relatively speaking, this is like throwing a glass of water on a forest fire, but in the short term it will certainly tighten-up the economy which will trigger that bona fide recession everyone was fearing. In truth, the real economy has been in recession for years. As our globalized economy continues its tailspin due to the suicidal economic policies implemented by leading western countries – like the United States, United Kingdom and the European Union, the original ‘Asian Tiger’ economy, Japan, is now on the verge of systemic collapse with “dramatic, unpredictable non-linearities” manifesting themselves in already over-stretched financial markets, warns Bloomberg, Deutsche Bank and others.

It’s no secret that Japan’s economy is massively over-leveraged and may very well see a repeat of its epic ‘lost decade’ from the infamous economic crash of the 1990s.

The tea leaves are alarming…

Zero Hedge reports…

Less than a week ago, we wrote that “As Yen Crash Accelerates, It Puts Catastrophic End Of MMT Experiment In The Spotlight” a less than cheerful assessment echoed this morning by Bloomberg, which writes that “Japan Starting to Crack as Yen Tumbles With Stocks and Bonds“ noting that despite the yen crashing to a 24-year low (for the same reasons we have repeated again and again, namely you can’t keep your 10Y yield at 0.25% and avoid a currency collapse in a scorching inflationary environment), Tokyo stocks were down the most since March.

But there was another major development, and one which suggests that days of fiat, and MMT are numbered: with Japanese yields surging, the Bank of Japan today bought more than 1.5 trillion yen of government bonds to defend its yield curve control target as the 10Y JGB rose above 0.25%, the upper end of the BOJ’s YCC corridor.

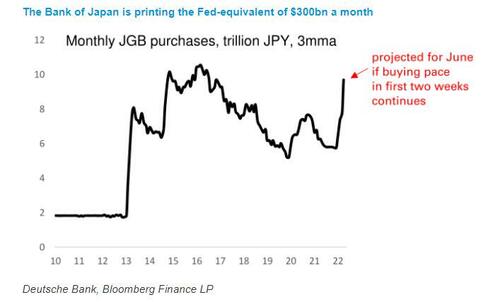

As Deutsche Bank’s George Saravelos shockingly calculates in a post this morning titled “The printer is on overdrive“, and available to professional ZH subscribers, if the current pace of buying persists, the bank will have bought approximately 10 trillion yen in June. To put that number in context, it is roughly equivalent to the Fed doing more than $300bn of QE per month when adjusting for GDP!

This is a “truly extreme” level of money printing given that every other central bank in the world is tightening policy. It is one of the reasons why we have been bearish on the yen. And as so many have argued, currency intervention in this environment is simply not credible given it is the BoJ itself that is the cause of yen weakness.

More broadly, Saravelos echoes what we said in our preview of the end of MMT, writing that he worries that “the currency and Japanese financial markets are in the process of losing any sort of fundamental-based valuation anchor.”

The more global inflation picks up, the more the BoJ prints. But the more easing accelerates, the higher the need to press hard on the brake when the (inflation) cliff approaches and the more dangerous it becomes. As a result, we will soon enter a phase where dramatic and unpredictable non-linearities in Japanese financial markets would kick in, according to the DB strategist, who also notes that “if it becomes obvious to the market that the clearing level of JGB yields is above the BoJ’s 25 basis point target, what is the incentive to hold bonds any more?”

This leave us with a few exploding questions:

- Is the BoJ willing to absorb the entirety of the Japanese government bond stock?

- Where is the fair value of the yen on this scenario and what happens if the BoJ changes its mind?

- The BoJ may want to generate inflation, but how does it get there with triggering a complete systemic collapse?

Finally, what happens if and when the yen careens off the fiat cliff, and domestic holders of yen-denominated savings flee into either dollars or cryptos? We will find out very soon.

READ MORE JAPAN NEWS AT: 21st Century Wire Japan Files

SUPPORT OUR INDEPENDENT MEDIA PLATFORM – BECOME A MEMBER @21WIRE.TV

Get Clive de Carle's Natural Health essentials of the finest quality, including vitamin & mineral supplements here.