Yesterday’s Italian election results have sent tremors through the bureaucratic maze of Brussels, as two populist EU skeptic parties the centerist-populist Five Star Movement (Movimento Cinque Stelle) and the right-wing nationalist Northern League (Lega Nord), managed impressive gains, with Five Star garnering the most popular votes during this election round.

However, with no clear majority, Italy is facing the prospect of a hung Parliament, in which case negotiations will begin between various parties to try and organize a coalition or a minority government which is able to govern. Sparta Report explains:

“The 5-Star Movement, although now the largest party, has officially vowed not to join any post-election coalitions. But Alessandro Di Battista welcomed other parties to come talk as long as they use 5-Star “methods” of “transparency” and “correctness” in political conduct.

The League officials are hinting that a break with the coalition may be coming, which would give a minority government under the 5-Star Movement with the League backing possible.”

The reason the establishment are uncomfortable with Italy’s Five Star Movement is because it does not fit neatly into a traditional Right or Left wing box and therefore, cannot be boxed-in by the establishment and the mainstream media.

Still, Technocrats in Brussels are worried about an EU referendum should populism gain a major foothold in Italy…

Five Star leader Luigi Di Maio upbeat following his party’s incredible performance.

Five Star leader Luigi Di Maio upbeat following his party’s incredible performance.

Market Watch reports…

Italy’s general election over the weekend showed a surprisingly strong result for the populist, euroskeptic parties, sparking fears the eurozone’s third-largest economy will be stuck with months of political instability.

Preliminary results from Sunday’s vote indicated around half of the voters cast their ballot in favor of anti-establishment parties 5 Star Movement and Lega Nord, or Northern League while the mainstream parties suffered a drop in support. The vote points to a hung parliament and political gridlock that could leave Italy in a limbo for months as the parties wrangle over possible coalitions.

Read: Italy’s election resulted in political gridlock as expected — what that means for stocks

The inconclusive result sent Italian stocks sharply lower on Monday, with the FTSE MIB Index I945, -1.26% down 1.3%. Italian 10-year yields TMBMKIT-10Y, +2.99% rose 7 basis points to 2.097%, in a sign investors are dumping the country’s assets. The euro EURUSD, -0.0730% initially headed lower, but trimmed losses during the European morning session.

Analysts braced for tough negotiations ahead and warned the messy result could soon lead to new elections. Here’s a round up of the initial comments:

• “After 2017 ultimately proved benign for eurozone political risk, the unexpected strong performance of the 5 Star Movement (M5S) brings these threats very much back to the forefront. Though M5S officials have toned down anti-euro rhetoric in recent months, the euroscepticism within the bloc could ultimately re-introduce the existential threat to eurozone stability long thought diminished. Forming a government has many challenges, but this result could dent the strong consensus support the euro currently enjoys. Italian bond spreads also have scope to widen modestly from current levels.” — Timothy Graf, head of macro strategy for EMEA at State Street Global Markets

• “It may take months of tortuous negotiations to form a government which apparently will need to be backed by one of the two big radical parties, the 5Stars or the eurosceptic Lega. The tail risk that Italy may be heading for a euro referendum remains low. Still, it is not zero. The result will force parties of very different persuasions to compromise. That makes truly radical outcomes unlikely.” — Holger Schmieding and Carsten Hesse, economists at Berenberg

• “A broad grand coalition would be well received by markets as it could result in political stability and fiscal discipline. Repeat elections could prolong uncertainty and weigh on Italian assets. An anti-establishment alliance of M5S and Lega, the worst case scenario for markets, looks unlikely due to different programs.”

— Matteo Ramenghi, chief investment officer for Italy, UBS Wealth Management.

• “The complexity of the Italian voting system makes it very difficult to establish what happens next and when, but neither of the anti-establishment Five Star movement or League parties are an attractive option for markets or the euro. Against this negative backdrop, investors can only be grateful that German coalition talks finally reached a conclusion, with Angela Merkel managing to hold on to her position as long-serving Chancellor, albeit in a fragile alliance.”

— Rebecca O’Keeffe, head of investment at Interactive Investor

• “Even in the case of a euroskeptic coalition of Five Star and Northern League emerging, we still think that the actual euro exit risk is low. However, such an outcome would still be the most adverse one for markets, given the combination of reform roll-back and significant fiscal easing, which could bring Italy’s debt woes quickly back into focus.”

— Danske Bank analysts

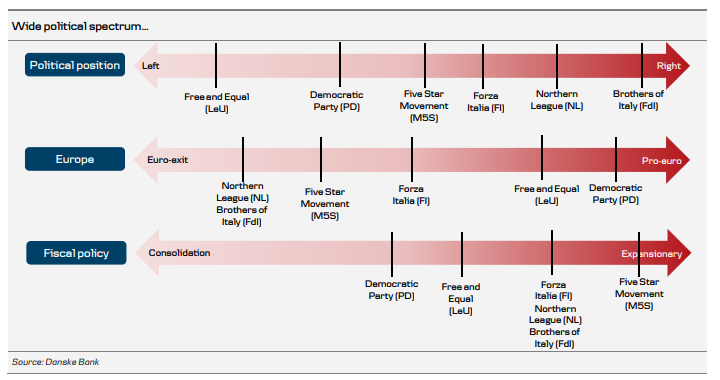

Danske Bank also highlighted how different the various parties are on the political spectrum, as shown in this chart below.

• “The big take away from these elections has been the extent to which the Italians have fallen out of love with the EU, voting in favour of far right and anti-establishment parties. Sweeping gains by anti-establishment, euroskeptic parties, such as the 5 Star Movement and the Lega Nord highlight the discontent felt by Italians over high levels of immigration and unemployment in Europe’s third-largest economy.

All the more surprising given that Italy is one of the founding members of the EU and has traditionally been one of its strongest supporters. A period of intense negotiations is set to begin late March/ early April in an attempt to form a government. The messy election outcome ensures a cloud of uncertainty will hover over Italy for the immediate future.”

— Jasper Lawler, head of research at London Capital Group

• “We expect the formation of a wide and heterogeneous coalition that could include anti-system parties. We do not expect such a coalition to deliver meaningful structural reforms, and depending on its composition, we see the risk that previous reforms could be unraveled. Over the medium term, we remain of the view that the next legislature will be characterized by political instability that could culminate in government crisis and or snap elections.”

— Barclays analysts

READ MORE ITALY NEWS AT: 21st Century Wire Italy Files

SUPPORT 21WIRE – SUBSCRIBE & BECOME A MEMBER @ 21WIRE.TV