A virtually unregulated investment firm today exercises more political and financial influence than the Federal Reserve and most governments on this planet.

F. William Engdahl

Global Research

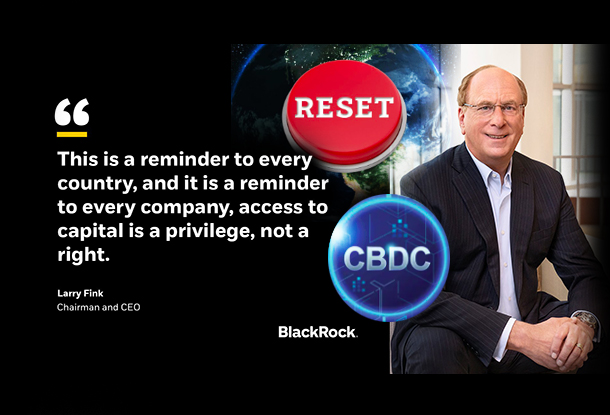

The firm, BlackRock Inc., the world’s largest asset manager, invests a staggering $9 trillion in client funds worldwide, a sum more than double the annual GDP of the Federal Republic of Germany. This colossus sits atop the pyramid of world corporate ownership, including in China most recently. Since 1988 the company has put itself in a position to de facto control the Federal Reserve, most Wall Street mega-banks, including Goldman Sachs, the Davos World Economic Forum Great Reset, the Biden Administration and, if left unchecked, the economic future of our world. BlackRock is the epitome of what Mussolini called Corporatism, where an unelected corporate elite dictates top down to the population.

How the world’s largest “shadow bank” exercises this enormous power over the world ought to concern us. BlackRock since Larry Fink founded it in 1988 has managed to assemble unique financial software and assets that no other entity has. BlackRock’s Aladdin risk-management system, a software tool that can track and analyze trading, monitors more than $18 trillion in assets for 200 financial firms including the Federal Reserve and European central banks. He who “monitors” also knows, we can imagine. BlackRock has been called a financial “Swiss Army Knife — institutional investor, money manager, private equity firm, and global government partner rolled into one.” Yet mainstream media treats the company as just another Wall Street financial firm.

There is a seamless interface that ties the UN Agenda 2030 with the Davos World Economic Forum Great Reset and the nascent economic policies of the Biden Administration. That interface is BlackRock.

Team Biden and BlackRock

By now it should be clear to anyone who bothers to look, that the person who claims to be US President, 78-year old Joe Biden, is not making any decisions. He even has difficulty reading a teleprompter or answering prepared questions from friendly media without confusing Syria and Libya or even whether he is President. He is being micromanaged by a group of handlers to maintain a scripted “image” of a President while policy is made behind the scenes by others. It eerily reminds of the 1979 Peter Sellers film character, Chauncey Gardiner, in Being There.

What is less public are the key policy persons running economic policy for Biden Inc. They are simply said, BlackRock. Much as Goldman Sachs ran economic policy under Obama and also Trump, today BlackRock is filling that key role. The deal apparently was sealed in January, 2019 when Joe Biden, then-candidate and long-shot chance to defeat Trump, went to meet with Larry Fink in New York, who reportedly told “working class Joe,” that, “I’m here to help.”

Now as President in one of his first appointees, Biden named Brian Deese to be the Director of the National Economic Council, the President’s main adviser for economic policy. One of the early Presidential Executive Orders dealt with economics and climate policy. That’s not surprising, as Deese came from Fink’s BlackRock where he was Global Head of Sustainable Investing. Before joining BlackRock, Deese held senior economic posts under Obama, including replacing John Podesta as Senior Adviser to the President where he worked alongside Valerie Jarrett. Under Obama, Deese played a key role in negotiating the Global Warming Paris Accords.

In the key policy post as Deputy Treasury Secretary under Secretary Janet Yellen, we find Nigerian-born Adewale “Wally” Adeyemo. Adeyemo also comes from BlackRock where from 2017 to 2019 he was a senior adviser and Chief of Staff to BlackRock CEO Larry Fink, after leaving the Obama Administration. His personal ties to Obama are strong, as Obama named him the first President of the Obama Foundation in 2019.

And a third senior BlackRock person running economic policy in the Administration now is also unusual in several respects. Michael Pyle is the Senior Economic Adviser to Vice President Kamala Harris. He came to Washington from the position as the Global Chief Investment Strategist at BlackRock where he oversaw the strategy for investing some $9 trillion of funds. Before joining BlackRock at the highest level, he had also been in the Obama Administration as a senior adviser to the Undersecretary of the Treasury for International Affairs, and in 2015 became an adviser to the Hillary Clinton presidential bid.

The fact that three of the most influential economic appointees of the Biden Administration come from BlackRock, and before that all from the Obama Administration, is noteworthy. There is a definite pattern and suggests that the role of BlackRock in Washington is far larger than we are being told.

What is BlackRock?

Never before has a financial company with so much influence over world markets been so hidden from public scrutiny. That’s no accident. As it is technically not a bank making bank loans or taking deposits, it evades the regulation oversight  from the Federal Reserve even though it does what most mega banks like HSBC or JP MorganChase do—buy, sell securities for profit. When there was a Congressional push to include asset managers such as BlackRock and Vanguard Funds under the post-2008 Dodd-Frank law as “systemically important financial institutions” or SIFIs, a huge lobbying push from BlackRock ended the threat. BlackRock is essentially a law onto itself. And indeed it is “systemically important” as no other, with possible exception of Vanguard, which is said to also be a major shareholder in BlackRock.

from the Federal Reserve even though it does what most mega banks like HSBC or JP MorganChase do—buy, sell securities for profit. When there was a Congressional push to include asset managers such as BlackRock and Vanguard Funds under the post-2008 Dodd-Frank law as “systemically important financial institutions” or SIFIs, a huge lobbying push from BlackRock ended the threat. BlackRock is essentially a law onto itself. And indeed it is “systemically important” as no other, with possible exception of Vanguard, which is said to also be a major shareholder in BlackRock.

BlackRock founder and CEO Larry Fink is clearly interested in buying influence globally. He made former German CDU MP Friederich Merz head of BlackRock Germany when it looked as if he might succeed Chancellor Merkel, and former British Chancellor of Exchequer George Osborne as “political consultant.” Fink named former Hillary Clinton Chief of Staff Cheryl Mills to the BlackRock board when it seemed certain Hillary would soon be in the White House.

He has named former central bankers to his board and gone on to secure lucrative contracts with their former institutions. Stanley Fisher, former head of the Bank of Israel and also later Vice Chairman of the Federal Reserve is now Senior Adviser at BlackRock. Philipp Hildebrand, former Swiss National Bank president, is vice chairman at BlackRock, where he oversees the BlackRock Investment Institute. Jean Boivin, the former deputy governor of the Bank of Canada, is the global head of research at BlackRock’s investment institute.

BlackRock and the Fed

It was this ex-central bank team at BlackRock that developed an “emergency” bailout plan for Fed chairman Powell in March 2019 as financial markets appeared on the brink of another 2008 “Lehman crisis” meltdown. As “thank you,” the Fed chairman Jerome Powell named BlackRock in a no-bid role to manage all of the Fed’s corporate bond purchase programs, including bonds where BlackRock itself invests. Conflict of interest? A group of some 30 NGOs wrote to Fed Chairman Powell, “By giving BlackRock full control of this debt buyout program, the Fed… makes BlackRock even more systemically important to the financial system. Yet BlackRock is not subject to the regulatory scrutiny of even smaller systemically important financial institutions.”

In a detailed report in 2019, a Washington non-profit research group, Campaign for Accountability, noted that, “BlackRock, the world’s largest asset manager, implemented a strategy of lobbying, campaign contributions, and revolving door hires to fight off government regulation and establish itself as one of the most powerful financial companies in the world.”

The New York Fed hired BlackRock in March 2019 to manage its commercial mortgage-backed securities program and its $750 billion primary and secondary purchases of corporate bonds and ETFs in no-bid contracts. US financial journalists Pam and Russ Martens in critiquing that murky 2019 Fed bailout of Wall Street remarked, “for the first time in history, the Fed has hired BlackRock to “go direct” and buy up $750 billion in both primary and secondary corporate bonds and bond ETFs (Exchange Traded Funds), a product of which BlackRock is one of the largest purveyors in the world.” They went on, “Adding further outrage, the BlackRock-run program will get $75 billion of the $454 billion in taxpayers’ money to eat the losses on its corporate bond purchases, which will include its own ETFs, which the Fed is allowing it to buy…”

Fed head Jerome Powell and Larry Fink (image, left) know each other well, apparently. Even after Powell gave BlackRock the hugely lucrative no-bid “go direct” deal, Powell continued to have the same BlackRock manage an estimated $25 million of Powell’s private securities investments. Public records show that in this time Powell held direct confidential phone calls with BlackRock CEO Fink. According to required financial disclosure, BlackRock managed to double the value of Powell’s investments from the year before! No conflict of interest, or?

Fed head Jerome Powell and Larry Fink (image, left) know each other well, apparently. Even after Powell gave BlackRock the hugely lucrative no-bid “go direct” deal, Powell continued to have the same BlackRock manage an estimated $25 million of Powell’s private securities investments. Public records show that in this time Powell held direct confidential phone calls with BlackRock CEO Fink. According to required financial disclosure, BlackRock managed to double the value of Powell’s investments from the year before! No conflict of interest, or?

A Very BlackRock in Mexico

BlackRock’s murky history in Mexico shows that conflicts of interest and influence-building with leading government agencies is not restricted to just the USA. PRI Presidential candidate Peña Nieto went to Wall Street during his campaign in November 2011. There he met Larry Fink. What followed the Nieto victory in 2012 was a tight relationship between Fink and Nieto that was riddled with conflict of interest, cronyism and corruption.

Most likely to be certain BlackRock was on the winning side in the corrupt new Nieto regime, Fink named 52-year-old Marcos Antonio Slim Domit, billionaire son of Mexico’s wealthiest and arguably most corrupt man, Carlos Slim, to BlackRock’s Board. Marcos Antonio, along with his brother Carlos Slim Domit, run the father’s huge business empire today. Carlos Slim Domit, the eldest son, was Co-Chair of the World Economic Forum Latin America in 2015, and currently serves as chairman of the board of America Movil where BlackRock is a major investor. Small cozy world.

Get Clive de Carle's Natural Health essentials of the finest quality, including vitamin & mineral supplements here.

The father, Carlos Slim, at the time named by Forbes as World’s Richest Person, built an empire based around his sweetheart acquisition of Telemex (later America Movil). Then President, Carlos Salinas de Gortari, in effect gifted the telecom empire to Slim in 1989. Salinas later fled Mexico on charges of stealing more than $10 billion from state coffers.

As with much in Mexico since the 1980s drug money apparently played a huge role with the elder Carlos Slim, father of BlackRock director Marcos Slim. In 2015 WikiLeaks released company internal emails from the private intelligence corporation, Stratfor. Stratfor writes in an April 2011 email, the time BlackRock is establishing its Mexico plans, that a US DEA Special Agent, William F. Dionne confirmed Carlos Slim’s ties to the Mexican drug cartels. Stratfor asks Dionne, “Billy, is the MX (Mexican) billionaire Carlos Slim linked to the narcos?” Dionne replies, “Regarding your question, the MX telecommunication billionaire is.” In a country where 44% of the population lives in poverty you don’t become the world’s richest man in just two decades selling Girl Scout cookies.

Fink and Mexican PPP

With Marcos Slim on his BlackRock board and new president Enrique Peña Nieto, Larry Fink’s Mexican partner in Nieto Peña’s $590 billion PublicPrivatePartnership (PPP) alliance, BlackRock, was ready to reap the harvest. To fine-tune his new Mexican operations, Fink named former Mexican Undersecretary of Finance Gerardo Rodriguez Regordosa to direct BlackRock Emerging Market Strategy in 2013. Then in 2016 Peña Nieto appointed Isaac Volin, then head of BlackRock Mexico to be No. 2 at PEMEX where he presided over corruption, scandals and the largest loss in PEMEX history, $38 billion.

Peña Nieto had opened the huge oil state monopoly, PEMEX, to private investors for the first time since nationalization in the 1930s. The first to benefit was Fink’s BlackRock. Within seven months, BlackRock had secured $1 billion in PEMEX energy projects, many as the only bidder. During the tenure of Peña Nieto, one of the most controversial and least popular presidents, BlackRock prospered by the cozy ties. It soon was engaged in highly profitable (and corrupt) infrastructure projects under Peña Nieto including not only oil and gas pipelines and wells but also including toll roads, hospitals, gas pipelines and even prisons.

Notably, BlackRock’s Mexican “friend” Peña Nieto was also “friends” not only with Carlos Slim but with the head of the notorious Sinaloa Cartel, “El Chapo” Guzman. In court testimony in 2019 in New York Alex Cifuentes, a Colombian drug lord who has described himself as El Chapo’s “right-hand man,” testified that just after his election in 2012, Peña Nieto had requested $250 million from the Sinaloa Cartel before settling on $100 million. We can only guess what for.

Larry Fink and WEF Great Reset

In 2019 Larry Fink joined the Board of the Davos World Economic Forum, the Swiss-based organization that for some 40 years has advanced economic globalization. Fink, who is close to the WEF’s technocrat head, Klaus Schwab, of Great Reset notoriety, now stands positioned to use the huge weight of BlackRock to create what is potentially, if it doesn’t collapse before, the world’s largest Ponzi scam, ESG corporate investing. Fink with $9 trillion to leverage is pushing the greatest shift of capital in history into a scam known as ESG Investing. The UN “sustainable economy” agenda is being realized quietly by the very same global banks which have created the financial crises in 2008. This time they are preparing the Klaus Schwab WEF Great Reset by steering hundreds of billions and soon trillions in investment to their hand-picked “woke” companies, and away from the “not woke” such as oil and gas companies or coal. BlackRock since 2018 has been in the forefront to create a new investment infrastructure that picks “winners” or “losers” for investment according to how serious that company is about ESG—Environment, Social values and Governance.

For example a company gets positive ratings for the seriousness of its hiring gender diverse management and employees, or takes measures to eliminate their carbon “footprint” by making their energy sources green or sustainable to use the UN term. How corporations contribute to a global sustainable governance is the most vague of the ESG, and could include anything from corporate donations to Black Lives Matter to supporting UN agencies such as WHO. Oil companies like ExxonMobil or coal companies no matter how clear are doomed as Fink and friends now promote their financial Great Reset or Green New Deal. This is why he cut a deal with the Biden presidency in 2019.

Follow the money. And we can expect that the New York Times will cheer BlackRock on as it destroys the world financial structures. Since 2017 BlackRock has been the paper’s largest shareholder. Carlos Slim was second largest. Even Carl Icahn, a ruthless Wall Street asset stripper, once called BlackRock, “an extremely dangerous company… I used to say, you know, the mafia has a better code of ethics than you guys.”

***

Author F. William Engdahl is strategic risk consultant and lecturer, he holds a degree in politics from Princeton University and is a best-selling author on oil and geopolitics, exclusively for the online magazine “New Eastern Outlook” where this article was originally published.

He is a Research Associate of the Centre for Research on Globalization.

READ MORE GREAT RESET NEWS AT: 21st Century Wire Great Reset Files

ALSO JOIN OUR TELEGRAM CHANNEL

PLEASE HELP SUPPORT OUR INDEPENDENT MEDIA PLATFORM HERE