Does Starlink have a monopoly on satellite internet at the moment?

While it’s true that other firms are launching units into space, right now Starlink does have a virtual monopoly on satellite to ground services. No other constellation in orbit that comes close in terms of latency or bandwidth capability.

There is also the important issue of receiver ground stations being available and reliable.

In a recent interview, Eva Berneke, CEO of satellite firm Eutelsat, said there is still demand for more competition in the satellite internet sector, following her firm’s recent merger with UK LEO firm OneWeb. Speaking with AFP, Berneke said, “We have a lot of customers who want us to get there quickly… they tell us they took Starlink because there wasn’t anybody else. But they want competition too. Nobody wants a monopoly.”

This week, two serious player announced they will be joining forces in order to gain a piece to Starlink’s market share…

Arts Technica reports…

Facing competition from Starlink and other emerging satellite broadband networks, the two companies that own most of the traditional commercial communications spacecraft in geostationary orbit announced plans to join forces Tuesday.

SES, based in Luxembourg, will buy Intelsat for $3.1 billion. The acquisition will create a combined company boasting a fleet of some 100 multi-ton satellites in geostationary orbit, a ring of spacecraft located more than 22,000 miles (nearly 36,000 kilometers) over the equator. This will be more than twice the size of the fleet of the next-largest commercial geostationary satellite operator.

The problem is that demand is waning for communication services through large geostationary (GEO) satellites. There are some large entrenched customers, like video media companies and the military, that will continue to buy telecom capacity on geostationary satellites. But there’s a growing demand among consumers, and some segments of the corporate and government markets, for the types of services offered by constellations of smaller satellites flying closer to Earth.

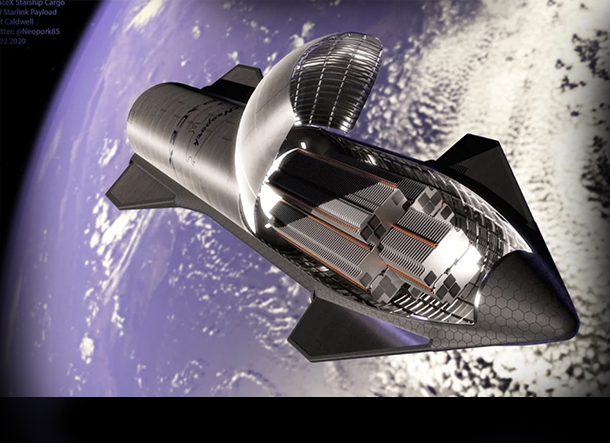

The biggest of these constellations, by far, is SpaceX’s Starlink network, with more than 5,800 active satellites in its low-Earth orbit fleet a few hundred miles above Earth. Each of the Starlink satellites is smaller than a conventional geostationary platform but linked together with laser communication terminals; thousands of these spacecraft pack enough punch to eclipse the capacity of Internet networks anchored by geostationary satellites. Starlink now has more than 2.6 million subscribers, according to SpaceX.

Satellites in low-Earth orbit (LEO) offer some advantages over geostationary satellites. Because they are closer to users on the ground, low-Earth orbit satellites provide signals with lower latency. The satellites for these constellations can be mass-produced at relatively low cost compared to a single geostationary satellite, which often costs $250 million or more to build and launch…

Continue this story at Arts Technica

READ MORE SCI-TECH NEWS AT: 21st CENTURY WIRE SCI-TECH FILES

ALSO JOIN OUR TELEGRAM CHANNEL

SUPPORT OUR INDEPENDENT MEDIA PLATFORM – BECOME A MEMBER @21WIRE.TV