While globalist luminaries at Davos and their political counterparts in government – all wax lyrical about ‘transitioning’ the global car fleet over to supposedly more ‘green’ electric vehicles, few are prepared to have the sober conversation about how unrealistic this entire project really is.

In the UK, the brakes could be put on their increasing electric vehicle sales due to the fact that there’s now a worldwide shortage in lithium needed for the millions of new car batteries being produced each month. Aside from a shortage driving up the cost of the batteries as well as the vehicles themselves, but locking into a policy of banning the sale of combustion engines by 2030, governments are painting their economies and their citizens into a dangerous corner.

There’s little doubt that the importance of securing a supply of this essential metal compound, along with other ingredients such as cobalt, is going to be a prerequisite if car manufacturers are going to invest and retool by pouring billions of pounds or euros into electrifying their future fleets.

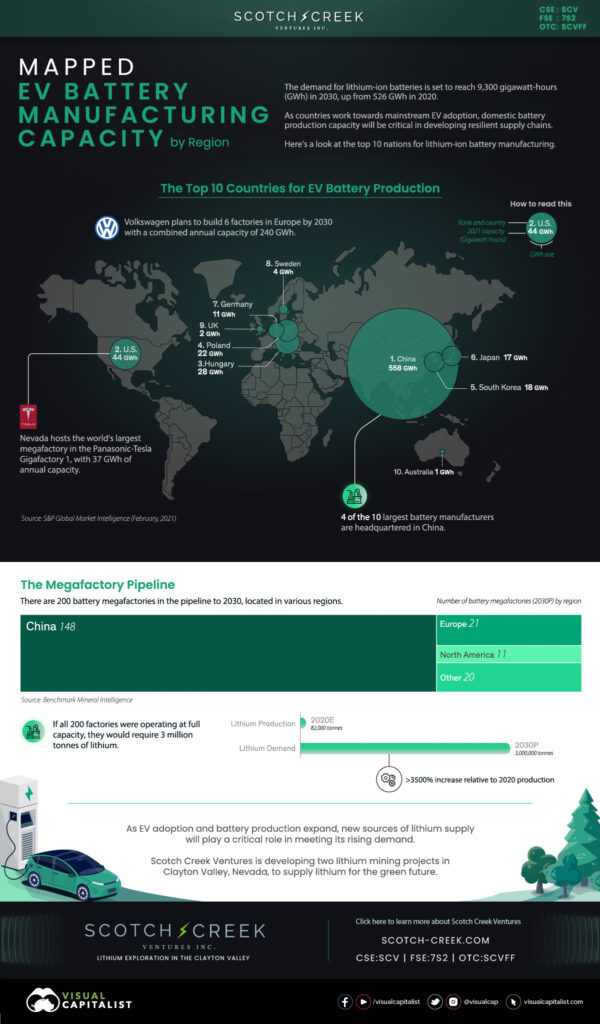

As it stands, most of the global battery supply is already spoken for.

Is Europe heading for a collision course with resource reality? If so, what are the geopolitical implications of this looming crisis considering that China controls more than half of the global supply?

FT reports…

Europe’s transition to electric cars is under threat because of persisting shortages of lithium, the key battery component that will power the vehicles of the future.

EU plans to ban sales of new petrol and diesel cars by 2035 mean demand for lithium is set to surge fivefold by 2030 to 550,000 tonnes per year — more than double the 200,000 tonnes the region will be able to produce, according to Benchmark Mineral Intelligence.

“The whole global market is still set to be in a deficit by the end of the decade,” said Daisy Jennings-Gray, analyst at Benchmark Mineral Intelligence. “Europe will probably sit in a tight position in terms of availability and cannot afford any delays to domestic projects [to extract the metal].”

The supply problem has been highlighted by the world’s largest lithium producer Albemarle, which has sidelined plans to extract lithium in Europe after failing to find a commercially viable site. “The resources we are aware of in Europe are not high quality and relatively small,” the group’s chief financial officer Scott Tozier told the Financial Times.

The projected lithium deficit in a market already suffering global shortages and high prices of $62,000 per tonne — more than five times the average cost of production despite a recent drop — may prove existential for European carmakers. Without a homegrown supply of the battery gold, Europe’s auto groups could find it difficult to compete with China, which is rapidly expanding its electric car industry and making inroads into the European market. A sign of China’s dominance in the field is that it controls 60 per cent of global lithium processing, which turns a concentrate produced from brine or ore into lithium chemical compounds such as carbonate or hydroxide that are used in car batteries.

Francis Wedin, chief executive of Australian-listed Vulcan Energy Resources, one of the few companies trying to extract lithium in Europe, said the region’s car industry would not be able to electrify its future fleet without its own lithium. China “will prioritise supply for its own industry”, he said. Without its own access to lithium, European carmakers would “not survive competition” from the country, he added…

READ MORE FINANCIAL NEWS AT: 21st Century Wire Financial Files

ALSO JOIN OUR TELEGRAM CHANNEL

PLEASE HELP SUPPORT OUR INDEPENDENT MEDIA PLATFORM HERE