Blake Lovewell

21st Century Wire

As we look back at 2023, and peer ahead into the new year, we can take a moment for thought and reflection. The last 12 months in the cryptocurrency sphere has seen a massive tumult – plenty of winners and losers, but with a continued expansion of the full fledged industry. Through crisis and successes, we’ll attempt to track a few key threads of discourse, as well as evaluate some pivotal events that have occurred. In our 24 hour news cycle, it is important to consider a wider perspective and trace trends to enlighten our perspective for the future.

We would be remiss to begin our summation of 2023 in cryptocurrency without discussing the wider economic context. We witnessed the swinging return of the controversial ‘i’ word: Inflation. It is something that many, especially in the United States and Europe, will have forgotten about. We’ve been fortunate in the advanced West to have had, until 2020, two continuous decades of extremely low central bank interest rates. In this environment, economic growth was mainly burned in the central bank furnaces in order to print money. After the financial crisis of 2008, central banks had been on a money printing spree and by keeping the interest rates low they could offset this printing with the sale of treasuries at low interest rates. There was slow and steady, yet imperceptible, inflation in prices; below the mystical 2% standard promised by western central banks. Suddenly, in 2020, most nation states in the world decided to simultaneously enact strict policies of central control. Following the lead of infamous dictatorship China, countries from East to West foamed at the bit to restrict the activity of citizens and businesses. Suddenly small businesses were shuttered and forbidden to open, workers were told to stay home and police drones roamed the streets to monitor the citizenry of the world. This caused a huge economic black hole. There was little to no productivity – only certain large corporations were allowed to trade and remain open, to their own obscene profits. The rest of the global economy was put on an intra-venous drip of easy money. The printing spree turned binge, and the floodgates opened. Through programs such as furlough, the state would support recently imprisoned workers with state money. This government expenditure was funded by an unprecedented purchase of government debt by the central banks, think parents paying off the kids credit cards. For two years there were aggressive restrictions on economic activity and extreme state spending to sustain the economy and prevent total collapse. Now, three years down the line from the instigation of these policies, the chickens came home to roost.

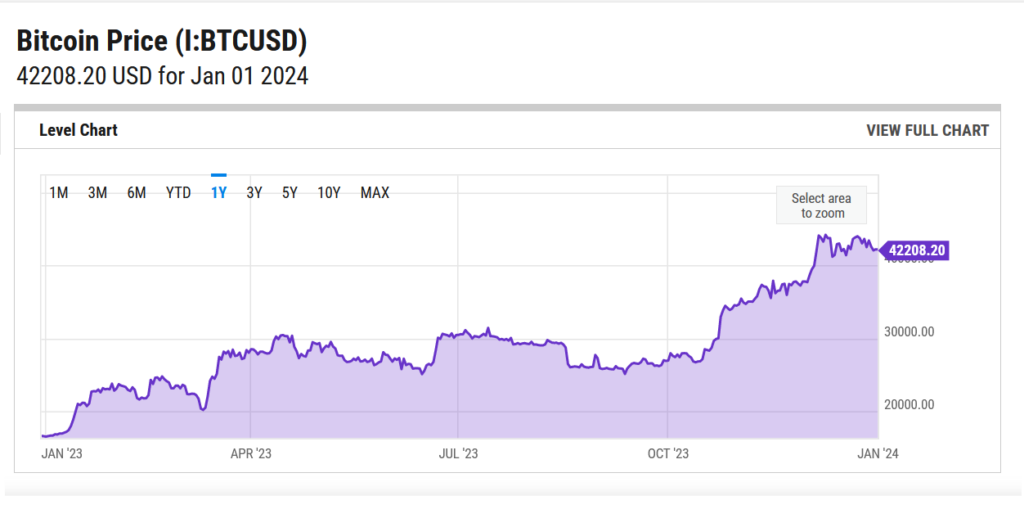

As economies around the world see stagflation, weak growth and economic uncertainty, cryptocurrency as a whole has taken a hit. Its rapacious growth was stemmed in the wake of the collapse of FTX in 2022 (see blelow) and concurrent bank failures in the USA in 2023. This means that easy money has exited the market – the government stipends have dried up and cryptocurrency as one of the beneficiaries of this easy money has taken a hit. The decline, as is a regular trend in cryptocurrency starts at the fringes. Alt-coins, those tiny speculative projects have been hard pressed to find suckers for their schemes. However, even top 10 coins have seen a diminishment. In these hard times people flock to the safest assets, and in cryptocurrency, Bitcoin is king. By the end of 2023 it returned to 50% dominance of the crypto market, having dipped to about 40% at its lowest.

Bitcoin as a hedge

Bitcoin is seen by some as a hedge against inflation and meandering central bank policy. If you hold an asset outside of the Dollar, Pound or Yen, you are insulated from the vagaries of their money printing policy. Whilst Bitcoin had fallen by 50% from its peak in 2021, it made-up a lot of ground through 2023. It also gained more resilience. The number of new wallets, which correlates to new users continued to steadily increase. The price in dollar terms increased too, ending the year on around $42,000 per Bitcoin. However, if we are true anarchists, we don’t attend to the price of Bitcoin in dirty fiat, which is only worth the paper it’s printed on. We pay more attention to the market fundamentals of Bitcoin, namely the ‘hash rate’. The global ‘hashrate’ is the sum total of computing power that is grinding away to solve Bitcoin’s equation and mine a block. This is a measure of people’s confidence in Bitcoin moving forward as investing in mining equipment and energy is expensive – almost out of the realm of the average Joe without lots of spare money. Global hashrate is at an all time high at the end of 2023, meaning miners are confident that Bitcoin will hold its value, or even go much higher, furthermore the network is more secure the more people who mine it so it is a good indicator of the increased health of Bitcoin’s network despite a tumultuous year.

I should mention here: ordinals. I mentioned them earlier in March of 2023 in conversation but they have come to greater prominence, booming in the Winter. An ordinal is a piece of information encoded into a Bitcoin transaction. It exploits a part of Bitcoins fundamental code whereby someone can add information in a Bitcoin transaction, perhaps to signify who the Bitcoin was transmitted to, or for what. Yet canny nerds have managed to use this field to fill with jpeg image codes, music file codes and other piles of information. These little units of information are then traded like NFTs (non-fungible tokens) and as they are on Bitcoin’s main blockchain they garner a lot of interest.

I should mention here: ordinals. I mentioned them earlier in March of 2023 in conversation but they have come to greater prominence, booming in the Winter. An ordinal is a piece of information encoded into a Bitcoin transaction. It exploits a part of Bitcoins fundamental code whereby someone can add information in a Bitcoin transaction, perhaps to signify who the Bitcoin was transmitted to, or for what. Yet canny nerds have managed to use this field to fill with jpeg image codes, music file codes and other piles of information. These little units of information are then traded like NFTs (non-fungible tokens) and as they are on Bitcoin’s main blockchain they garner a lot of interest.

By misusing this information field someone can transmit a transaction of 0.00000001 BTC, the smallest denomination of Bitcoin, and include 2mb of data which would fill a whole block on Bitcoin’s blockchain. We can think of a block mined on Bitcoin’s blockchain as a bus. Usually they come about every 10 minutes, and carry about 10,000 transactions in their 2mb capacity. Thus if I sent you 1 Bitcoin, it would arrive in about 10 minutes, alongside thousands of other transactions. One ordinal with a picture of a cat, however, can totally fill the bus, so my transaction would be stuck at the bus-stop (known as the memory pool) until the next bus in 20 minutes. You can see how the network effect of ordinals can cause a massive clogging of the network and there is currently a war over their usage.

Some mining pools, groups of miners, are disavowing any block with ordinals, so they can filter out the ‘true’ transactions, in their eyes. The trouble is not all pools agree on a set of rules for ordinals. Some other pools support the purist motion that all transactions are equal and no transactions should be censored; otherwise you become the same middlemen bankers and statists that Bitcoin set out to expunge in the first place. We have yet to see the outcome of this debate, but it is an important issue which could rock the foundations of Bitcoin if it induces a change in the base code which hasn’t been touched by hard-fork in about a decade. It is definitely one to watch moving forward.

IMAGE: Sam Bankman-Fried: autist and gamer turned crypto finance and banking savant.

The Collapsed FTX and the Trial of SBF

FTX rose to prominence in 2021, hitting a million users. It was a cryptocurrency exchange, allowing users to trade and hold crypto. It also offered its own token, FTT, to use as intermediary when trading. It quickly grew from its shady beginnings to a million users, and sponsoring a sports arena before its collapse in 2022.

The shady beginnings I refer to were the ascendency of a small group of MIT alumni to the top of the USA’s political and economic spheres. Obviously, as with most corruption, there is an unhealthy dose of nepotism. Bankman and Fried, Sam Bankman-Fried’s parents were high up Stanford economists. Though they present themselves as having a back-seat role, SBF’s father did help draft legal documents for the creation of Alameda Research in 2017. But perhaps more pertinent is the connection with MIT. Carole Ellison was part of the polycule that instigated FTX. Her father was Gary Gensler’s boss when he worked at MIT. Gensler segued smoothly from his role as economics professor, where he advocated for Ripple; a burgeoning payments technology which just partnered with Mastercard – into his role as head of the Securities Exchange Commission. Thus we have a tight ring between two of the founders of FTX, the movers and shakers at the top of the USA’s universities and the boss of the SEC – the institution in charge of regulating shady financial instruments. Perhaps, I add with dripping sarcasm, this had something to do with the easy ride FTX had through regulation.

That easy ride was verily lubricated by significant political donations. It is not all out in the open as SBF used plenty of obfuscation in donations. We do though know that at his peak SBF donated over $100million in the US mid-terms from FTX users’ deposits. These donations were linked to Senate leaders such as Mitch McConnell and Chuck Schumer. Also infamously he was blown a kiss by Democrat Congresswoman Maxine Waters on a visit to the American Capitol. To the political establishment’s great chagrin, just months later, FTX would completely collapse. Having funneled billions of dollars of customer funds into Alameda Research and losing some big gambles, the whole empire became insolvent.

SBF had cannily based his company in the Bahamas, ensuring a nice safe haven for their business activities. Thus after the collapse, SBF was holed up in the Bahamas and it took some machinations to get him back to the USA to face a jury. 2023 would see the fallen SBF attend trial in the USA on charges including fraud, wire fraud and conspiracy. He was released to his parents multi-million dollar property on bail; set at $250 million, the largest ever bail bond. Although in July 2023, after being caught witness tampering, he was remanded in prison.

During the trial, which mostly focussed on the illicit credit lines between Alameda Research, the shady trading venture, and FTX, the cryptocurrency empire. SBF would claim ignorance of much of the activities which took place on his watch and in his name. Countless billions of dollars of customers’ money were though accounted for and traced into the black hole, estimates start at the $8 billion mark. Similarly many of the political donations would lead straight into the ether and, usefully for US politicians, fall outside the remit of the trial. In fact the campaign donations violation charge was dropped from the docket at the behest of the Bahamas. They would not extradite SBF on that charge, we presume due to US political pressure.

One aspect of corruption ongoing is the return of customer funds. Autism Capital, a crypto researcher, claims that user funds are being returned at the lower dollar value from 2 years ago whilst FTX’s legal team are able to sell the underlying asset off at 4 times the market value and pocket the difference. He also highlights the deliberately weak coverage of SBF’s campaign funding violation trial – whereby the political dimension of corruption could be revealed.

Addendum: Fortunately, I waited until the very last day of the year to finish this article. We were presented with the news in late December that whilst SBF was found guilty on 7 charges earlier in 2023, that the second trial, for 5 more charges including unlawful campaign contributions, would be dropped. The Department of Justice claim they have already seen much of the evidence and that the case should be dropped in the interest of expediency. We can therefore conclude that the SBF case exemplifies the corruption of the US political class of today. There is an open door between regulators and corrupt actors to ensure that predatory financial corporations are allowed to victimise customers with no oversight or prevention. It also highlights how the politicians themselves are owned by their donors, be they economic such as SBF, or military such as Nikki Haley being on the board of Boeing, I digress.

The Spectre of Regulation

As aforementioned, the job of regulating crypto in the USA seems to fall unto the SEC. The SEC was created in the shadow of the Wall Street crash. FDR was on a spate of alphabet agency creation; this agency was to protect investors from the exigencies of high-risk financial schemes. However, as with most regulation bodies they become co-opted by the groups whose behaviour they should be curtailing and often become toothless pawns. The case of SBF, Gensler and the SEC demonstrates this – and Gensler’s role is still under some scrutiny. However, there is much political lobbying for cryptocurrency and related industries to fall under the remit of the CFTC: the Commodity Futures Trading Commission. They are similarly poised to regulate, in particular, speculative investment devices – such as stock investment. They also are seeking to bring crypto under their wing by expanding their purview. Throughout 2023, the US Senate have held a commission on this expansion of CFTC’s role in regulating cryptocurrency as well as the burgeoning carbon credit markets.

A second and vitally important arena of regulation to mention is ETFs. An ETF, an Exchange-traded Fund is a financial instrument that people can buy or sell in a similar way to a stock or share. Some ETFs are bundles of shares held by a company. ETFs are pertinent here because a number of the biggest investment firms in the world are vying to create a Bitcoin spot ETF. This would be tied to the price of Bitcoin – it would be a bet on if you think the price of Bitcoin would go up or down. An ETF allows people to participate in the hype around Bitcoin without the regulatory jamboree of buying and taking the actual asset into self-custody.

The SEC is currently the institution that regulates ETFs and given the huge upside potential, they are the prime target for lobbying. BlackRock, the biggest asset holder in the world, is in prime position to push out their Bitcoin spot ETF in 2024, which would have a massive price on Bitcoin itself. If the ETF sold too much at a certain price, there would be an incentive to hold Bitcoin’s market value either higher or lower, leading to market manipulation. Therefore if BlackRock, a massive asset holder, can run a worldwide bet on Bitcoin’s price they can effectively manipulate the price. Tie that in with malicious actors in the sphere who have other interests and you can see potential for market rigging on a large scale. As Max Keiser points out, the only solution to the burgeoning ETF market is for deep-pocketed investors to begin picking up vast quantities of underlying Bitcoin itself to ensure the asset remains in public hands. As yet we still await these angel investors appearance.

El Salvador – Bitcoin country

We cannot bring up the arch-maximalist Mac Keiser, formerly of RT, without mentioning his side venture, as economic adviser to El Salvadorian president Nayib Bukele. El Salvador has seen something of a tidal shift in the last few years. Nayib Bukele, a mild populist leader, managed to pull back some power from the omnipresent USA in El Salvador. The country had been plagued by gang violence as the hub for the notorious MS-13 gang. Many gang members were forcefully extradited from US prisons into El Salvador, causing a wave of criminality. Bukele came into power, apparently mild-mannered but behaved as a strong-man. Strict regimes of policing were created and he has cut El Salvadorian crime to a huge degree. It has gone from the most dangerous countries in the Americas, with shootings every day, to one of the safest with months with no violent crime at all. His policies have not been without detractors, as humanitarian charities have challenged his imprisonment of so many gang members, but his approval ratings are high.

In parallel with the crime crackdown, Bukele introduced Bitcoin to El Salvador. With Keiser by his side, he went further in adoption of Bitcoin than any State leader has to this point. Not only did he adopt Bitcoin as legal tender / currency, as other states already have, he also invested central bank funds in Bitcoin, making El Salvador itself a big holder of Bitcoin. Furthermore he established a Bitcoin wallet for Salvadoreans and gave every citizen a stipend of about a week’s wages in Bitcoin. Whilst it has only been a qualified success with low usage of the wallet, El Salvador has seen a growth in GDP whilst many South American countries have seen a fall or stagnation. Furthermore El Salvador are on the brink of launching their own volcano powered mining operation and bond scheme to allow foreign investment into the ‘Bitcoin nation’. There is also blooming interest in Arab Gulf states in Bitcoin, with rumours abounding about their possible entrance into the sphere. If a Saudi Arabia or Qatar began moving their central bank funds into Bitcoin, we would see a ‘God Candle’ and it would move the legitimacy of Bitcoin to a much higher level. Whilst this is great cause for optimism for Bitcoin’s price, we must always balance that by saying no official statement has been made formally.

The Rest of the Field

The cryptocurrency sphere is huge. It used to fit mainly inside one forum, bitcointalk.org which was the hub for all cryptocurrency for the early years. Nowadays there are hundreds of full-time publications, each churning out high-end analyses of the cryptocurrency market. The cryptocurrency market is rated at a value of over $1trillion. There are thousands of coins, tokens and products constantly innovating, some shorter lived than a damsel-fly. Plus we have the growing acceptance of institutions around the world who flex and adapt to the new landscape and evolve regulation in tandem with innovation. Thus it is an impossible task to give a deep dive on crypto in one article. But I have picked out some more salient trends, ones to watch for the new year – which should give a little gestalt, a sprinkling of pixels from the bigger picture view.

The first is the case of Binance. Binance is the biggest cryptocurrency exchange in the world; it has its own token, BNB, used for billions of dollars of trading each year. They have always skirted the fringe of regulation, locating offices in various Caribbean and Asian islands and hopping jurisdictions regularly. This year, the USA caught up with Binance and launched a class-action lawsuit. Binance had encouraged American users to use proxy servers to access their services and skirt US controls on crypto. This ended up with Binance paying billions to the USA, and their CEO stepping down. This indicates a big win for US regulation as they have poached one of the bigger sharks in the sphere.

Binance falling to the regulators may, in the long term, spell the end of Binance itself – as they appear to have had a lot of shady business going on in the background. As with any crypto exchange there are accusations of market manipulation and the bending of international laws is not always well received. The intense oversight and scrutiny also puts the stopper on many of their activities. One important point for me is the regulation of privacy coins. Privacy coins, like Monero and to a lesser extent Zcash, allow users to interact and transact privately. Even though their blockchain is public, there is no way to decipher who is transacting, how much, and when. This allows for people to evade censorship, and state control. Obviously the success of these technologies is a massive thorn in the side of global power structures who seek to control as much as possible the lives of the people. This is pertinent to the Binance case as Binance has been pressured to drop Zcash and Monero from their exchange by US regulators. It is not the first time that Monero for example has been dropped from exchanges for fear of regulation, but it indicates a step further in the battle of the State vs. Privacy technologies. We note too the US government’s Luddite attempts to make any type of encryption illegal. It is a battle worth watching as these privacy technologies usually keep ahead of government regulation – Monero doesn’t require Binance to function, it is designed to be peer-to-peer and fully decentralised, and continues to grow.

Another one to watch is Tether. Tether is the biggest stablecoin. A stablecoin is a token that is tied to the price of a currency, in this case, the US Dollar. Because 1 USDT (Tether’s token name) is worth 1 US Dollar, people can arbitrage their cryptocurrencies virtually with something that resembles a digital dollar. This is important for a variety of reasons. Firstly, the USA along with all other developed nations, have been working to create a fully digital version of their currencies, this allows for greater control and scrutiny over transactions. You can look into my other articles on CBDCs (Central Bank Digital Currencies) for a much deeper dive on this topic. Another aspect of the Tether story though, is that it has to back its digital token with ‘real-world’ assets. The way they choose to do so is by buying US treasuries. These are certificates issued by the USA at a certain interest rate – the state will pay the bearer a fixed interest rate over a fixed time period, for example a 2-year treasury might earn you 2% interest when it matures. The trouble for the US treasury in 2023 is that they have burned up most of their street credibility. Most people don’t believe that the US have the power to ensure the dollar is worth similar or more on a 2, 5 or 10 year period. This is due to 2 things: the first is that in sanctioning Russia, the USA said they would not honour any treasuries held by the Russian state, thereby defaulting on the debt and losing face. Secondly, the Federal Reserve has had trouble throughout 2023 in keeping inflation under control and looks weak. This means that having a buyer like Tether, who must buy treasuries to remain liquid, and back their ever expanding book of assets, is very important. Some commentators think that Tether is one of the few backstops propping up the US treasury market and ensuring the USA doesn’t publicly default on its debt.

As we can see, in just a few years Tether have become a linchpin for the US economy and show no signs of slowing. Their biggest competitor, USDC, another stablecoin, lost the faith of the markets as it was tied in with Signature Bank, which went down in the flames of the FTX fiasco. Tether is cemented as number 1 for now. But I believe that, similarly to Binance, its days are numbered. They too have a history of negligent behaviours and an opaque operating procedure. They refused to be properly audited for many years and even now, many don’t believe their accounting. They are also tied into multiple complaints of price manipulation with Bitcoin. There is an open case in court declaring that Tether issued USDT and bought up cheap Bitcoin on the news, thereby manipulating the price and garnering huge private profits – this is market rigging.

Furthermore, in November 2023, Tether was caught in the ‘Authorised, not minted’ scandal. Here they ‘authorised’ the creation of $1 billion of USDT on Christmas Day, but didn’t mint it directly into tokens and release it to the public. Instead they held it in reserve, but the authorisation itself caused a huge pump in Bitcoin price. Anybody with advance knowledge of the authorisation could stand to make huge profits in another case of market manipulation, and it seems on statistical analysis that certain actors did. Whether this too will be borne out in a court case, we are yet to see but it is indeed shady behaviour from a huge player in the crypto space. A worrying sign no less.

I would go as far as to say that Tether is the test case for future stablecoin technology. Not only does USDT help the US government and operate as a middleman in cryptocurrency trading, but it operates as a functional currency in states where the local currency is untrustworthy. In Lebanon for example, the central bank defaulted on its debts and effectively became bankrupt. The Lebanese Pound became useless as a currency with its value in freefall, so USDT, Tether, became one of the fallback currencies. It’s certainly an interesting time for financial innovation, but I implore people to be wary of technologies presented as ‘the next best thing’ or which seem extremely convenient as they may be masking inhumane profit-seeking motives, as I believe Tether do.

Do look out in the new year for the threads unravelling from some of the small tears in the tapestry I have highlighted here. For those of us who are interested in crypto – these times are enjoyable and worrying in equal measure.

As for predictions, we can only go on what we have seen so far, and that is a rollercoaster of ups and downs, a myriad of controversies and always a rogue actor lurking in the shadows. Similarly there are huge causes for cautious optimism, the resilience of the cypherpunk ideology is heartening, so too is the slow pace of institutional progress to deal with the new era of finance in cryptocurrency.

It is worth reminding you, lastly, of the old maxims of crypto: ‘Trust no-one, Do Your Own Research’, ‘Hodl – to the moon’ and ‘Not your keys, not your coins’. Perhaps these could be a new year’s resolution if you are still looking for one.

***

SEE ALSO:

Blake Lovewell: The 7 Pillars of a Global CBDC System

INTERVIEW: Blake Lovewell – ‘2024 Crypto and Bitcoin Outlook’

READ MORE BITCOIN NEWS AT: 21st Century Wire Bitcoin Files

SUPPORT OUR WORK BY SUBSCRIBING & BECOMING A MEMBER @21WIRE.TV