Americans are blaming Biden for the stagflationary economy, but at least the stock market is safe… for now.

Lance Roberts from Real Investment Advice writes…

As the stock market hit all-time highs this past week, there remains an interesting disconnect from the more dour economic concerns of the average American. A recent survey by Axios, a left-leaning website that supports the current Administration, addressed this issue.

“Poll after poll shows that the country is bummed out by the economy. Voters blame Biden. Nearly four in 10 Americans rate their financial situation as poor, according to a new Axios Vibes survey by The Harris Poll. In the language of our new Vibes series — which taps into the depth of Americans’ feelings — those surveyed feel sad about jobs and the economy.”

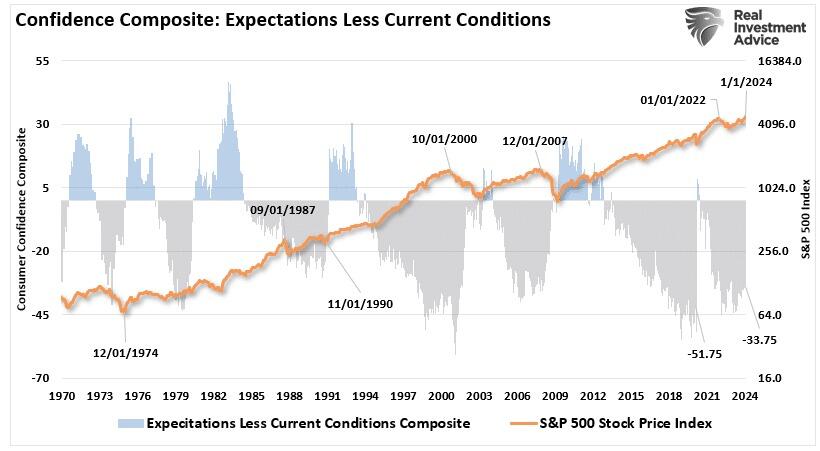

We compile a consumer sentiment composite index using the University of Michigan and Conference Board measures to confirm that assessment. Interestingly, while the stock market is hitting all-time highs, the gap between economic expectations and current conditions remains profoundly negative.

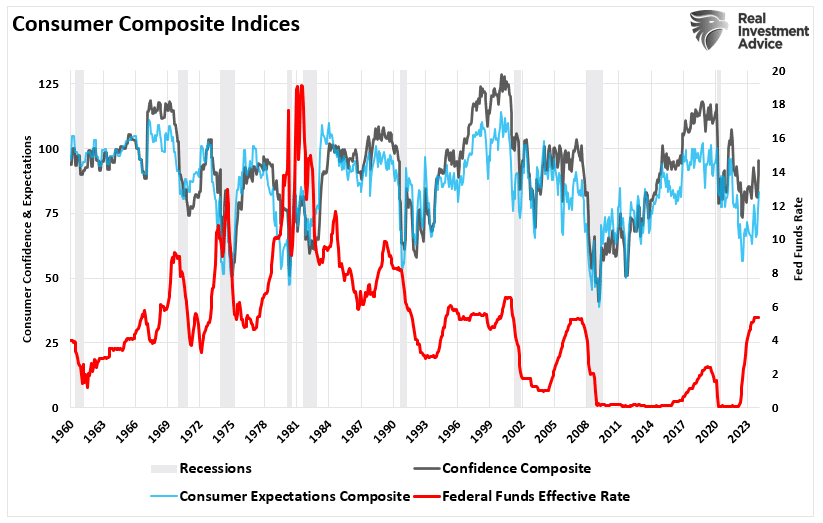

That gap should be unsurprising given the increases in borrowing costs directly impacting the average American. As shown, both the headline composite sentiment index and expectations are far off their highs as the Federal Reserve aggressively hiked borrowing costs.

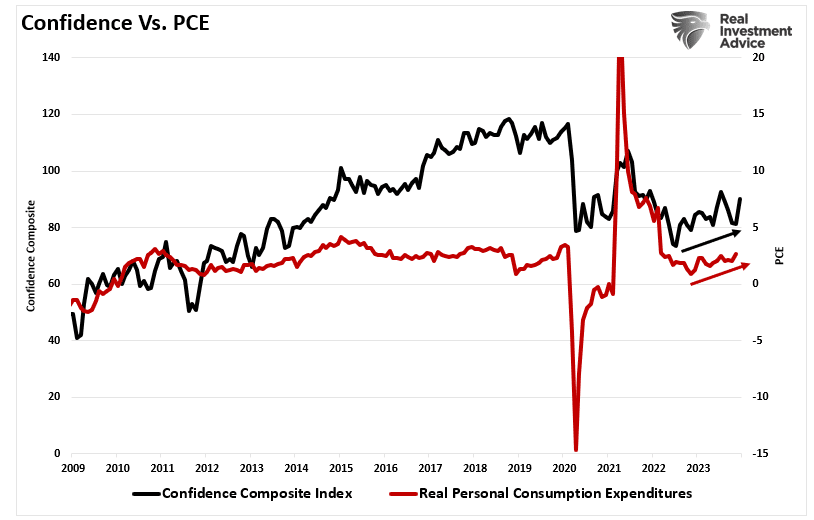

However, the upside is that if the market can continue to register further all-time highs, which we will discuss why in a moment, such should translate into increased consumer confidence. Such is because even though the average household has very little money invested in the financial markets, the drumbeat of all-time highs from the media reduces economic concerns. Improvements in consumer confidence lead to increases in consumer spending, which translates into economic growth.

However, the upside is that if the market can continue to register further all-time highs, which we will discuss why in a moment, such should translate into increased consumer confidence. Such is because even though the average household has very little money invested in the financial markets, the drumbeat of all-time highs from the media reduces economic concerns. Improvements in consumer confidence lead to increases in consumer spending, which translates into economic growth.

Continue this analysis at Real Investment Advice

READ MORE FINANCIAL NEWS AT: 21st CENTURY WIRE FINANCE FILES

ALSO JOIN OUR TELEGRAM CHANNEL

SUPPORT OUR INDEPENDENT MEDIA PLATFORM – BECOME A MEMBER @21WIRE.TV